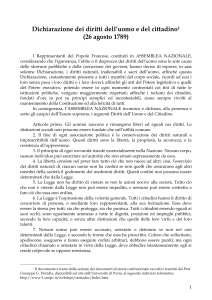

![[FORMULARIO] [Per il corso di Data Mining e Statistica per il](//s1.studylibit.com/store/data/005291898_1-1df697f347fcbd9a0a842a75091c5040-768x994.png)

[FORMULARIO]

[Per il corso di Data Mining e Statistica per il Mercato Finanziario]

Antonello D’Ambra

INDICI DESCRITTIVI:

s2 =

r= p

Pn

i=1 (xi

− x̄)2

n

Pn

Pn

(xi − x̄)(yi − ȳ)

i=1 xi yi − nx̄ȳ

p

=

= pPn i=1

Pn

Pn

Pn

2

2 − nx̄2

2

2

2

Dev(x)Dev(y)

(y

−

ȳ)

(x

−

x̄)

x

i=1 yi − nȳ

i=1 i

i=1 i

i=1 i

Cod(x; y)

TEORIA DEL PORTAFOGLIO:

n

r̄t =

vP =

T

X

n

1X

ri

n i=1

sb2t =

1 X

(ri − r̄t )2

n − 1 i=1

vt × at

wt =

vP

vt × at

t=1

r̄P =

T

X

r̄t × wt

t=1

sb2P = (w1 × sb1 )2 + (w2 × sb2 )2 + (2 × w1 × w2 × sb1 × sb2 × r12 )

sb2P = (w1 ×b

s1 )2 +(w2 ×b

s2 )2 +(w3 ×b

s3 )2 +(2×w1 ×w2 ×b

s1 ×b

s2 ×r12 )+(2×w1 ×w3 ×b

s1 ×b

s3 ×r13 )+(2×w2 ×w3 ×b

s2 ×b

s3 ×r23 )

MODELLO DI REGRESSIONE SEMPLICE:

Cod(x; y)

b1 =

=

Dev(x)

Pn

Pn

(xi − x̄)(yi − ȳ)

xi yi − nx̄ȳ

i=1

Pn

= Pi=1

n

2

2

2

(x

−

x̄)

i=1 i

i=1 xi − nx̄

B1 ∼ N β1 ;

σ2

Dev(x)

b0 = ȳ − b1 x̄

1

x̄2

B 0 ∼ N β0 ; σ 2

+

n Dev(x)

sse = Dev(Y ) − b21 Dev(X)

sse = Dev(Y ) − b1 Cod(X; Y )

IL MODELLO DI REGRESSIONE MULTIPLA:

B ∼ N β; σ 2 (XT X)−1

DIAGNOSTICA DEL MODELLO DI REGRESSIONE:

−1 (i − 0.5)

zi = Φ

δ = max[|F (x) − Φ(x)|]

n

Ppos

Pn

[ i=1 ai (xn−i+1 − xi )]2

(e

− e )2

i=2

Pn

Pni−1 2 i

w=

dw

=

2

i=1 (xi − x̄)

i=1 ei

1

MODELLI PER DATI PANEL:

Sorgente

Regressione

Residuo

Totale

Devianza

SSR

SSE

SST

Within/Dummy

n+k−1

N −k−n

N −1

GdL

Between

k

n−k−1

n−1

FGLS

k

N −k−1

N −1

Test di Hausman:

H = (BW − BF GLS )T [VC(BW ) − VC(BF GLS )]−1 (BW − BF GLS ) =

(BW − BF GLS )2

∼ χ2k

[VC(BW ) − VC(BF GLS )]

IL MODELLO DI REGRESSIONE LOGISTICA:

T

−1

B ∼ N β; (X VX)

exp(b0 + b1 xi1 + b2 xi2 + . . . + bk xik )

1 + exp(b0 + b1 xi1 + b2 xi2 + . . . + bk xik )

pi =

n

X

ln[L(y; b)] =

[yi ln(pi ) + (1 − yi ) ln(1 − pi )]

ln[L(y; 0)] = n1 ln

i=1

2

rM

=1−

1−

2

rN

=

L(y;b)

L(y;0)

L(y; b)

L(y; 0)

n2

= 1 − exp

n2

1 − exp

2

1 − [L(y; b)] n

=

−

n1

n

+ n2 ln

n2

n

2

ln[L(y; b)] − ln[L(y; 0)]

n

ln[L(y; b)] − ln[L(y; 0)]

2

rM

=

2 )

max(rM

1 − exp n2 ln[L(y; b)]

−

2

n

MASSIMA VEROSIMIGLIANZA:

Variabile Casuale Bernoulliana

L(x; π) = π

Pn

i=1

xi

(1 − π)

n−

Pn

i=1

xi

ln[L(x; π)] = ln(π)

n

X

n

X

xi + ln(1 − π)

(1 − xi )

i=1

i=1

Pn

S(x; π) =

i=1

xi

π

Pn

−

n − i=1 xi

1−π

=(T M L ) =

n

π(1 − π)

Variabile Casuale Poissoniana

Pn

λ i=1 xi

L(x; λ) = exp(nλ) Qn

i=1 xi !

ln[L(x; λ)] = −nλ + ln(λ)

n

X

i=1

n

S(x; λ) = −n +

1X

xi

λ i=1

=(T M L ) =

xi −

n

X

i=1

n

λ

Test statistici

LR =

L

−2{ln[L(x; tM

vincolata )]

− ln[L(x; t

ML

L

L(x; tM

vincolata )

)]} = −2 ln

L(x; tM L )

2

T M L − θ0

W = p

=(T M L )−1

2

ln(xi !)

![[FORMULARIO] [Per il corso di Data Mining e Statistica per il](http://s1.studylibit.com/store/data/005291898_1-1df697f347fcbd9a0a842a75091c5040-768x994.png)