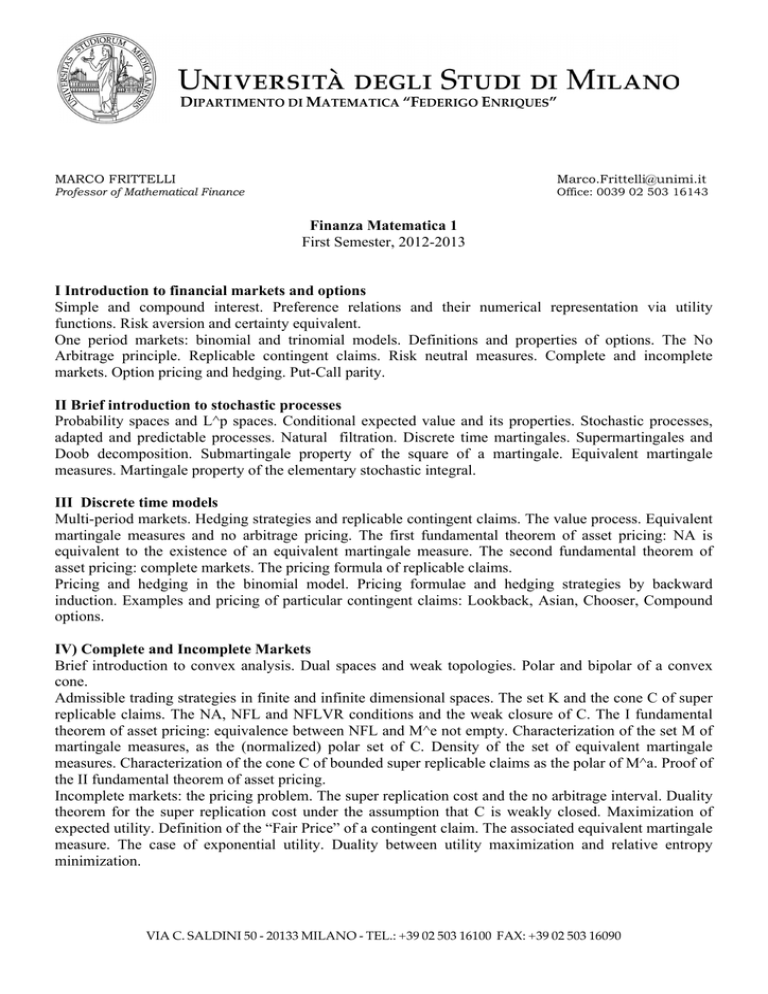

DIPARTIMENTO DI MATEMATICA “FEDERIGO ENRIQUES”

MARCO FRITTELLI

[email protected]

Professor of Mathematical Finance

Office: 0039 02 503 16143

Finanza Matematica 1

First Semester, 2012-2013

I Introduction to financial markets and options

Simple and compound interest. Preference relations and their numerical representation via utility

functions. Risk aversion and certainty equivalent.

One period markets: binomial and trinomial models. Definitions and properties of options. The No

Arbitrage principle. Replicable contingent claims. Risk neutral measures. Complete and incomplete

markets. Option pricing and hedging. Put-Call parity.

II Brief introduction to stochastic processes

Probability spaces and L^p spaces. Conditional expected value and its properties. Stochastic processes,

adapted and predictable processes. Natural filtration. Discrete time martingales. Supermartingales and

Doob decomposition. Submartingale property of the square of a martingale. Equivalent martingale

measures. Martingale property of the elementary stochastic integral.

III Discrete time models

Multi-period markets. Hedging strategies and replicable contingent claims. The value process. Equivalent

martingale measures and no arbitrage pricing. The first fundamental theorem of asset pricing: NA is

equivalent to the existence of an equivalent martingale measure. The second fundamental theorem of

asset pricing: complete markets. The pricing formula of replicable claims.

Pricing and hedging in the binomial model. Pricing formulae and hedging strategies by backward

induction. Examples and pricing of particular contingent claims: Lookback, Asian, Chooser, Compound

options.

IV) Complete and Incomplete Markets

Brief introduction to convex analysis. Dual spaces and weak topologies. Polar and bipolar of a convex

cone.

Admissible trading strategies in finite and infinite dimensional spaces. The set K and the cone C of super

replicable claims. The NA, NFL and NFLVR conditions and the weak closure of C. The I fundamental

theorem of asset pricing: equivalence between NFL and M^e not empty. Characterization of the set M of

martingale measures, as the (normalized) polar set of C. Density of the set of equivalent martingale

measures. Characterization of the cone C of bounded super replicable claims as the polar of M^a. Proof of

the II fundamental theorem of asset pricing.

Incomplete markets: the pricing problem. The super replication cost and the no arbitrage interval. Duality

theorem for the super replication cost under the assumption that C is weakly closed. Maximization of

expected utility. Definition of the “Fair Price” of a contingent claim. The associated equivalent martingale

measure. The case of exponential utility. Duality between utility maximization and relative entropy

minimization.

VIA C. SALDINI 50 - 20133 MILANO - TEL.: +39 02 503 16100 FAX: +39 02 503 16090

DIPARTIMENTO DI MATEMATICA “FEDERIGO ENRIQUES”

V Brief introduction to stochastic processes

On the Brownian Motion (BM) and continuous time martingales. The exponential martingale. The BM

paths are not of finite variation. Quadratic variation of the BM. The stochastic integral w.r.to the BM and

the martingale property. Ito processes and Ito formula. Novikov Lemma and Girsanov Theorem. The

predictable representation property. Examples of stochastic differential equations.

VI Continuous time markets and the Black and Scholes (BS) model

The BS model and the no arbitrage principle. Existence of an equivalent martingale measure. The BS

formula, its probabilistic and analytic proofs. Study of the BS partial differential equation. Greeks. Delta

and Gamma hedging. Portfolio insurance.

Implied volatility and the smile effect. Limitations of the BS model and brief account on alternatives.

Contingent claim pricing in incomplete continuous time markets. Pricing in models with one tradable

risky asset and one non-tradable risky asset: the partial differential equation and the market price of risk.

The calibration problem. Remarks on local volatility and stochastic volatility models.

Testi di riferimento:

S. Pliska: “Introduction to Mathematical Finance”, Blackwell, 1997.

S. Shreve: “Stochastic Calculus for Finance I and II”, Springer, 2004.

T. Bjork: “Arbitrage Theory in Continuous Time”, 2nd Edition, Oxford University Press, 2004.

A. Pascucci: “Calcolo stocastico per la finanza” Springer, 2008.

C. Aliprantis, K. Border: “Infinite Dimensional Analysis”, 3rd Edition, Springer 2006.

D. Williams: “Probability with martingales”, Cambridge University Press, 1991.

VIA C. SALDINI 50 - 20133 MILANO - TEL.: +39 02 503 16100 FAX: +39 02 503 16090