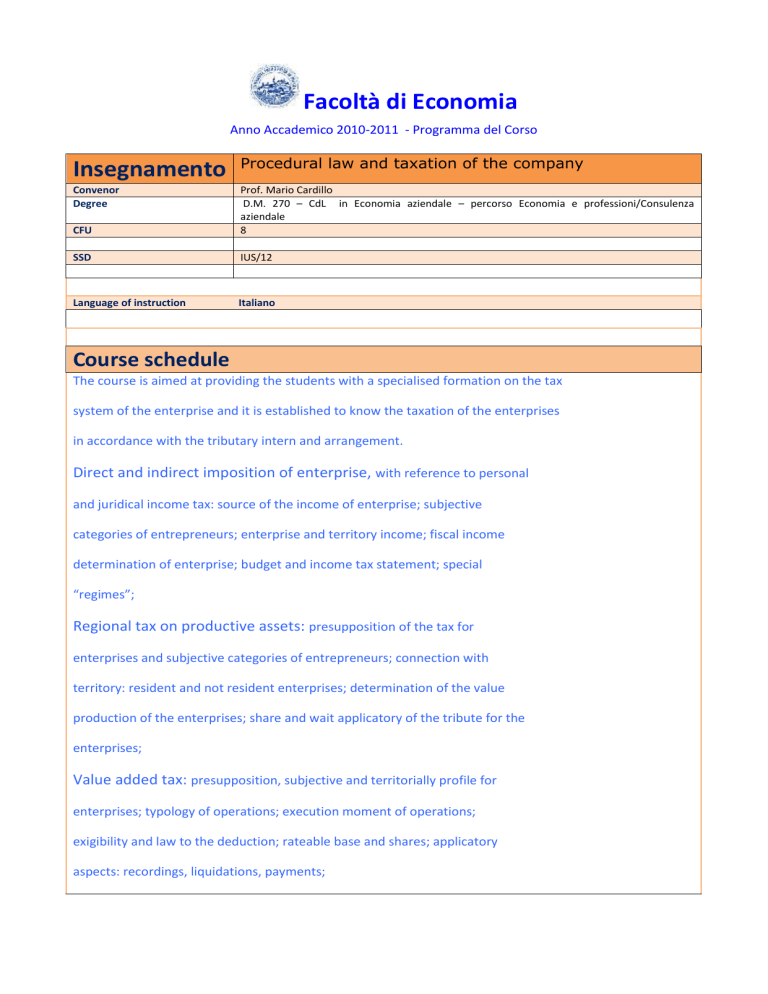

Facoltà di Economia

Anno Accademico 2010-2011 - Programma del Corso

Insegnamento

Procedural law and taxation of the company

Convenor

Degree

CFU

Prof. Mario Cardillo

D.M. 270 – CdL in Economia aziendale – percorso Economia e professioni/Consulenza

aziendale

8

SSD

IUS/12

Language of instruction

Italiano

Course schedule

The course is aimed at providing the students with a specialised formation on the tax

system of the enterprise and it is established to know the taxation of the enterprises

in accordance with the tributary intern and arrangement.

Direct and indirect imposition of enterprise, with reference to personal

and juridical income tax: source of the income of enterprise; subjective

categories of entrepreneurs; enterprise and territory income; fiscal income

determination of enterprise; budget and income tax statement; special

“regimes”;

Regional tax on productive assets: presupposition of the tax for

enterprises and subjective categories of entrepreneurs; connection with

territory: resident and not resident enterprises; determination of the value

production of the enterprises; share and wait applicatory of the tribute for the

enterprises;

Value added tax: presupposition, subjective and territorially profile for

enterprises; typology of operations; execution moment of operations;

exigibility and law to the deduction; rateable base and shares; applicatory

aspects: recordings, liquidations, payments;

Facoltà di Economia

Anno Accademico 2010-2011 - Programma del Corso

Register tax: presupposition of the tribute and action categories of

enterprise; recording;

Other indirect taxation: signs to excises, render fiscal, minor tributes and

local tax anterprise;

Imposition of enterprises with international activity: enterprise fiscality

in national and foreign operations of productive assets, in the generational

passage and in the state of crisis; profiles of fiscal planning; elusion and tax

evasion of the enterprise and relative contrast of norms.

COMPANY PROCEDURAL LAW (n.4 CFU)

The tributary contentious jurisdiction: the juridical tutelage in the tributary

law; the development of the contentious jurisdiction system; the relationships

between the contentious jurisdiction discipline and the constitutional norms about

the jurisdiction; the contentious jurisdiction system in the tributary reformation; the

tributary commissions; the jurisdiction of the tributary commissions; the judgement

before the provincial tributary commission; the special procedures; the system of

impugnation.

Recommended texts:

You can prepare for the exam by studying the subject on one of the following course

textbooks of your choice:

1. A. Fantozzi, Il diritto tributario, UTET, 2003 (ult. Ed.) (parte gen., cap. 6°;

parte speciale, I tributi erariali (con escl. del cap. 3° della sez. I));

2. P. Russo, Manuale di diritto tributario, parte speciale (con escl. del cap. III),

Giuffrè, 2005;

Facoltà di Economia

Anno Accademico 2010-2011 - Programma del Corso

3. N. D’Amati, Diritto Tributario, vol. I (parte II, III) e vol. II (parte VI, VII, VIII,

IX, X), Cacucci, 2005 -oppure- N. D'Amati, Istituzioni di Diritto Tributario,

Cacucci, 2005 ( con escl. della parte 1°, 3° cap.8° e 9°, 5°, 6°, 7° 10°, 11°)

4. F. Tesauro, Istituzioni di diritto tributario, vol. II, parte speciale (con escl. del

cap. 6° e cap. 13°) e parte generale (solo cap. 8) UTET, 2004 (ult. Ed.);

5. G. Falsitta, Manuale di diritto tributario, parte speciale (con escl. del cap. 4°),

Cedam, 2003 (ult. Ed.);

6. R. Lupi, Diritto tributario, parte speciale (con escl. della sez. D), Giuffrè,

2005;

7. E. De Mita, Principi di diritto tributario, Giuffrè, 2004, parte II (con escl. del

cap.7°; del titolo II e della parte 4°, il cap. 1° n. II ed il cap.2°).

Additional didactic material will be provided by the teacher during the course:

Slides

Teaching methods:

Lectures - Tutorials. The course will be articulated in class lessons and

exercises where students are required to review and debate recent trends in

tax law in the light of the most significant judgments

Convenor

Contact details

E-mail

Prof. Mario Cardillo

0881.781739

[email protected]

Office hours

Every morning from 09.00 am to 12.30 pm