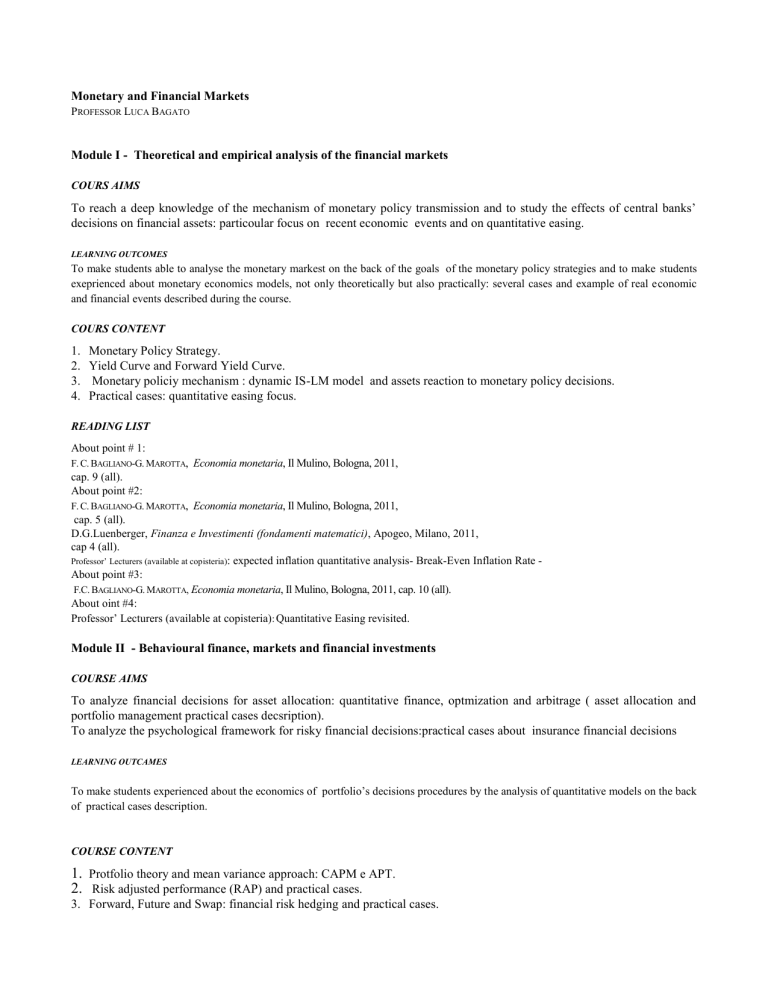

Monetary and Financial Markets

PROFESSOR LUCA BAGATO

Module I - Theoretical and empirical analysis of the financial markets

COURS AIMS

To reach a deep knowledge of the mechanism of monetary policy transmission and to study the effects of central banks’

decisions on financial assets: particoular focus on recent economic events and on quantitative easing.

LEARNING OUTCOMES

To make students able to analyse the monetary markest on the back of the goals of the monetary policy strategies and to make students

exeprienced about monetary economics models, not only theoretically but also practically: several cases and example of real economic

and financial events described during the course.

COURS CONTENT

1.

2.

3.

4.

Monetary Policy Strategy.

Yield Curve and Forward Yield Curve.

Monetary policiy mechanism : dynamic IS-LM model and assets reaction to monetary policy decisions.

Practical cases: quantitative easing focus.

READING LIST

About point # 1:

F. C. BAGLIANO-G. MAROTTA, Economia monetaria, Il Mulino, Bologna, 2011,

cap. 9 (all).

About point #2:

F. C. BAGLIANO-G. MAROTTA, Economia monetaria, Il Mulino, Bologna, 2011,

cap. 5 (all).

D.G.Luenberger, Finanza e Investimenti (fondamenti matematici), Apogeo, Milano, 2011,

cap 4 (all).

Professor’ Lecturers (available at copisteria): expected inflation quantitative analysis- Break-Even Inflation Rate About point #3:

F.C. BAGLIANO-G. MAROTTA, Economia monetaria, Il Mulino, Bologna, 2011, cap. 10 (all).

About oint #4:

Professor’ Lecturers (available at copisteria): Quantitative Easing revisited.

Module II - Behavioural finance, markets and financial investments

COURSE AIMS

To analyze financial decisions for asset allocation: quantitative finance, optmization and arbitrage ( asset allocation and

portfolio management practical cases decsription).

To analyze the psychological framework for risky financial decisions:practical cases about insurance financial decisions

LEARNING OUTCAMES

To make students experienced about the economics of portfolio’s decisions procedures by the analysis of quantitative models on the back

of practical cases description.

COURSE CONTENT

1. Protfolio theory and mean variance approach: CAPM e APT.

2. Risk adjusted performance (RAP) and practical cases.

3. Forward, Future and Swap: financial risk hedging and practical cases.

4. Psicology and asymmetrical financial markets : long run financial decisions,- psycology and risk analysis- practical

cases studies.

READING LIST

About point #1:

K. CUTHBERTSON-D. NITZSCHE, Economia finanziaria quantitativa, Bologna, il Mulino, 2005, cap. 5, (all) .

D.G.Luenberger, Finanza e Investimenti (fondamenti matematici), Apogeo, Milano, 2011,

cap 6 (all) e cap 7 (all).

About point #2:

K. CUTHBERTSON-D. NITZSCHE, Economia finanziaria quantitativa, Bologna, il Mulino, 2005, cap. 7, (all) .

D.G.Luenberger, Finanza e Investimenti (fondamenti matematici), Apogeo, Milano, 2011,

cap 8 (pp 222-227).

About point #3:

D.G. LUENBERGER, Finanza e Investimenti (fondamenti matematici), Apogeo, Milano, 2011,

cap 10 (all).

Per il punto 4:

K. CUTHBERTSON-D. NITZSCHE, Economia finanziaria quantitativa, Bologna, il Mulino, 2005, cap. 12, (pp. 253-271).

B. ALEMANNI-G. BRIGHETTI-C. LUCARELLI, Decisioni di investimento.assicurative e previdenziali, Bologna, il Mulino, 2012, cap. 2, (all), cap. 5

(all), cap. 6 (all) e cap. 7 (all).

TEACHING METHOD

Classrooms Lessons.

ASSESSMENT METHOD

Wrtitten examination

Prof. Luca Bagato receives students as at described on Economics Faculty ‘s bacheca.