GENERAL ACTUARIAL MODELS IN A SEMI-MARKOV

ENVIRONMENT

Jacques Janssen

CESIAF,

Bld Paul Janson, 84 bte 9

6000 Charleroi,

BELGIUM

Telephone: +3271304843

Fax: +3271305877

E-mail: [email protected]

Raimondo Manca

Università “La Sapienza”,

Dipartimento di Matematica per le Decisioni

Economiche, Finanziarie ed Assicurative,

via del Castro Laurenziano, 9,

00161 Roma,

ITALY

Telephone: +390649766302

Fax: +390649766765

E-mail: [email protected]

SYNOPSES

The first application of Semi-Markov Process (SMP) in actuarial field was given

by J. Janssen [9]. Many authors successively used these processes and their

generalizations for actuarial applications, (see Hoem, [6], Carravetta, De

Dominicis, Manca, [1], Sahin, Balcer, [16]). In some books it is also shown how

it is possible to use these processes in actuarial science, (see Pitacco, Olivieri,

[15], CMIR12 [17]).

These processes can be generalised introducing a reward structure see for example

Howard, [7]. in this way are defined the Homogeneous Semi-Markov Reward

Processes (HSMRWP). The Discrete Time Non-Homogeneous Semi-Markov

Reward Processes (DTNHSMRWP) were introduced in De Dominicis, Manca [3].

At the authors knowing these processes in actuarial field were introduced only for

the construction of theoretical models that were not yet applied, (see De

Dominicis, Manca, Granata, [4], Janssen, Manca, [11],[12]).

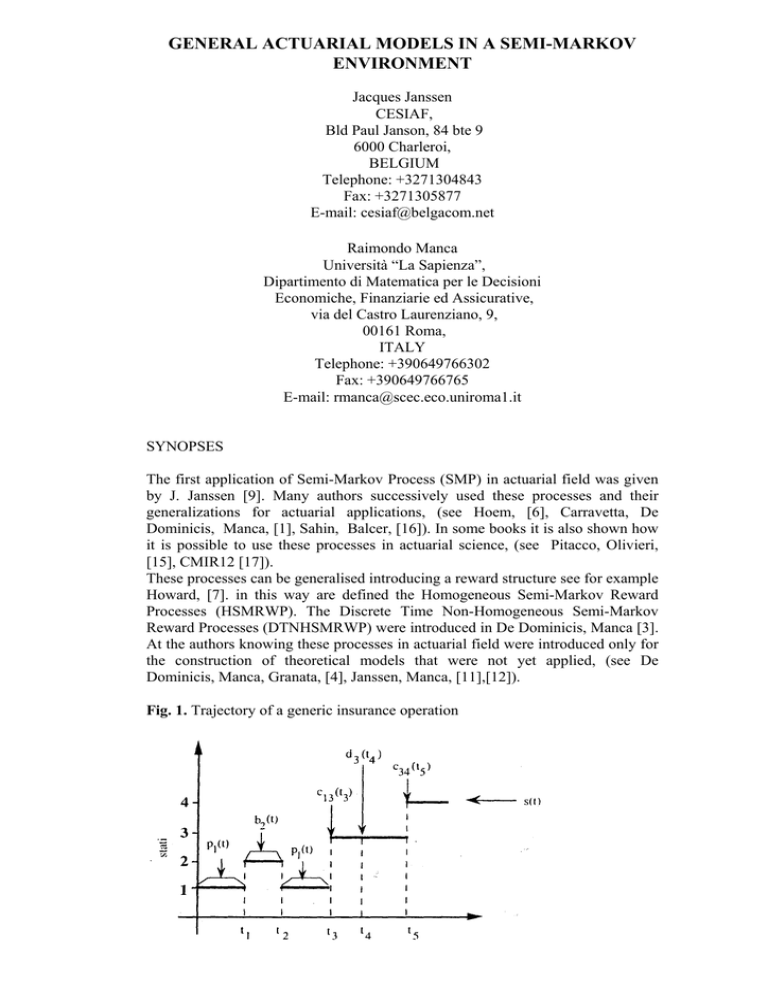

Fig. 1. Trajectory of a generic insurance operation

The applications proposed in those papers were in pension and in health

insurance. The authors are also working on the construction of a model for non

life insurance, more precisely in credit risk environment, using non-homogeneous

semi-Markov processes.

It is to outline that the models that are obtained for all actuarial applications that

the authors constructed are similar. They bring to SMRWP in which it is possible

to consider simultaneousely the future development of the state system and its

financial evolution.

The figure 1 is reported from Pitacco, Olivieri, [15].

The two authors explain that this can be considered a graph that gives a trajectory

of the stochastic process that describes an insurance operation.

Fig. 2. Trajectory of a SMP.

The figure 2 gives the trajectory of a possible evolution of a semi-Markov process

(see Janssen, [10] ).

It is evident that they have the same behaviour. And this can explain because the

actuarial models, in the authors opinion, are strictly connected to semi-Markov

processes.

Fig. 3. m states model for insurance operation.

In this light and after many experiences, the authors think that it is possible to face

any kind of actuarial problem by means of a model based on SMP. In this paper a

semi-Markov reward model that can afford a general actuarial problem will be

presented.

The graph describing this model is reported in figure 3.

It is to precise that the arcs are weighted and their weights can rpresent the change state

probabilities and the rewards that are paid in the case of change state Furthermore, also

the nodes, that represent the model states, are weighted and their weights represent the

reward paid or received remaining in the state. All rewards can be fixed or can change in

the time evolution of the model.

The formula of the evolution equation of a SMRWP that can take in account

simultaneusely all the aspects of a general actuarial problem will be given.

That formula is able to take in account all the possibility that can happen in an

actuarial problem.

In the paper will be explained how the formula and the related graph will change

in function of the actuarial problem that is to face.

REFERENCES

[1] Carravetta M., R. De Dominicis, R. Manca, “Semimarkov process in social

security problems”, in Cahiers du C.E.R.O., 1981.

[2] De Dominicis R., J. Janssen, An algorithmic approach to non-homogeneous

semi-Markov processes. Insurance: Mathematics and Economics 3, 157-165,

1984

[3] De Dominicis R., R. Manca, “Some new results on the transient behaviour of

semi-Markov reward processes”, Methods of Operations Research, 387-397

Verlag Anton Hain, 1985.

[4] De Dominicis R., R. Manca, M. Granata, “The Dynamics of Pension Funds in

a Stochastic Environment”, Scandinavian Actuarial Journal, 1992.

[5] Haberman S., E. Pitacco. Actuarial model for disability insurance. Chapman

& Hall. 1999.

[6] Hoem J.M., “Inhomogeneous semi-Markov processes, select actuarial tables,

and duration-dependence in demography”, in T.N.E. Greville, Population,

Dynamics, Academic Press, 251-296, 1972.

[7] Howard R., Dynamic probabilistic systems, vol II, Wiley, 1972.

[8] Iosifescu Manu A., “Non homogeneous semi-Markov processes”, Stud. Lere.

Mat. 24, 529-533, 1972

[9] Janssen J., “Application des processus semi-markoviens à un probléme

d’invalidité”, Bulletin de l”Association Royale des Actuaries Belges, 63, 35-52,

1966.

[10] Janssen J., “Semimarkov processes and applications in risk and queueing

theories”, Quaderni dell’Istituto di Matematica della Facoltà di Economia e

Commercio dell’Università di Napoli, n. 35, 1983.

[11] Janssen J., R. Manca, “A Realistic Non-Homogeneous Stochastic pension

Fund Model on Scenario Basis”, Scandinavian Actuarial Journal, 2, 113-137,

1997.

[12] Janssen J., R. Manca, “Non-homogeneous semi-Markov reward process for

the management of health insurance models”, Proceedings ASTIN Washington

(2001).

[13] Levy P., Processus semi-Markoviens. Proceedings of International Congress

of Mathematics (Amsterdam) 1954

[14] H. Mine and S. Osaki, Markovian decision processes, Elsevier, 1970.

[15] Pitacco E., A. Olivieri, Introduzione alla teoria attuariale delle assicurazioni

di persone, Quaderni dell’UMI, 42, Pitagora Editrice, Bologna, 1997.

[16] Sahin I., Y. Balcer, “Stochastic models for a pensionable service”,

Operations Research, 27, 888-903, 1979.

[17] CMIR12 (Continuous Mortality Investigation Report, number 12). The

analysis of permanent health insurance data. The Institute of Actuaries and the

Faculty of Actuaries, 1991